Prime Brokerage

Our flagship service, Celadon Prime®, combines robust prime brokerage services with advanced technology and extraordinary client support.

Open an account-

Celadon Prime®

-

Outsourced Trading

-

Direct Market Access

-

Securities Lending

-

Portfolio Reporting & Analytics

-

Trade Support

CELADON PRIME®

Celadon’s flagship service combines robust prime brokerage services, advanced technology, and extraordinary client support.

Professional investors in need of a flexible suite of prime brokerage, execution, and service agent solutions look to Celadon Prime®. Our clients enjoy the freedom to focus on their trading strategies while we seamlessly bundle global execution, financing, clearance, settlement, and reporting services. From the onset of the client relationship, a dedicated relationship manager provides high-touch support for everything from technology to back-office operations.

Through our multiple custodial partners, Celadon provides global clearance and settlement services, as well as direct market access to all principal US market centers and over 40 execution venues worldwide.

Celadon Prime® Portal. Celadon’s proprietary account management portal serves as the core element of our integrated prime brokerage clearing process.

- Easy away-trade entry

- Manage multiple accounts and custodians from a central dashboard

- Fully customizable functionality and display

MultiPrime. Diversify and minimize custodial risk and leverage market competition through multiple custodians.

- RBC Capital Markets

- Wedbush Securities

- Interactive Brokers

COMPREHENSIVE SUITE OF SERVICES

- Full-service agency trading desk

- DVP/RVP accounts

- Simplified “away trade” reporting interface

- Capital introduction

- Start-up solutions for new hedge funds

- Competitive execution and financing rates

- Reg T or portfolio margin

- Portfolio reporting and analytics

- Online account access for managers and administrators

- Securities lending

- Cash management

COMMISSION MANAGEMENT

- Defray up to the total cost of eligible brokerage and research costs

OUTSOURCED TRADING

Celadon’s outsourced agency desk adds significant value by helping clients execute their strategies without tying up the capital and resources needed to maintain an in-house trading operation.

An increasing number of buy-side firms have turned to outsourced trading in recent years. Clients benefit from Celadon’s significant investment in trading operations infrastructure and technology. We can act as a primary trading desk, complement an in-house desk, or provide additional coverage on busy trading days. By leveraging our trading desk, you gain an experienced team of traders, each with product expertise developed over decades that is difficult to replicate.

- Primary trading desk partnerships

- Complementary satellite trading teams

- Improved efficiency

- Comprehensive expertise

- World-class infrastructure and technology

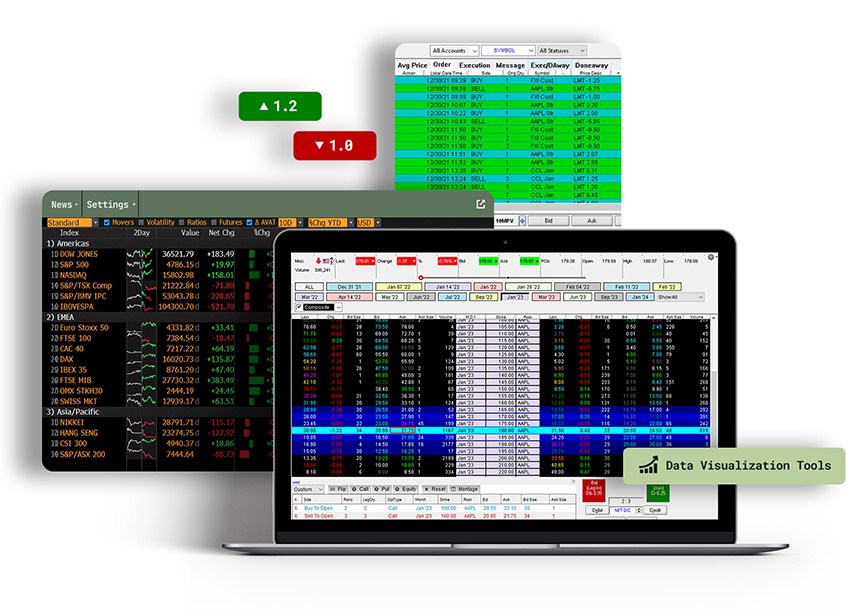

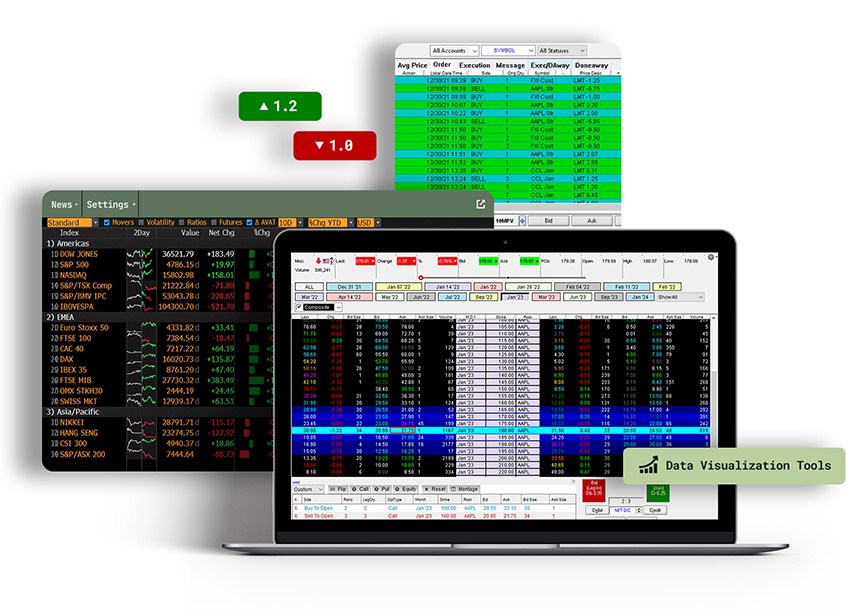

DIRECT MARKET ACCESS

Celadon provides qualified clients with broker-neutral order management systems that enable trading across all major asset classes and liquidity sources.

We are focused on providing high-performance trading infrastructure that serves as the foundation for our clients’ success. We rigorously evaluate electronic trading platforms based on an array of factors, ensuring that clients are equipped with the most advanced technology available: streaming market data, smart order routing, intuitive portfolio management tools, and more.

LEADING EDGE TECHNOLOGY

- Manage orders across all principal US market venues

- Full support for algorithmic trading strategies

- Approved systems support multiple order types, as well as integrated Level 1 and Level 2 data for ECN and exchange destinations

- Route orders to a designated venue or use smart routing features

- Point and click order pads and blotters, as well as “hot keys”

System Availability. We not only recommend these systems from leading vendors — we rely on them for our own trading.

- Sterling Trader Pro

- Refinitiv REDI Plus

SECURITIES LENDING

Celadon delivers flexible and competitive stock loan solutions to facilitate short sales or manage settlement risk.

- Traders view lists of easy-to-borrow and hard-to-borrow stocks directly within the trading platform

- Easy-to-borrow short sales executed seamlessly

- Agency desk assistance provided for short sales of hard-to-borrow stocks (e.g. subject to locate requirements)

PORTFOLIO REPORTING & ANALYTICS

Celadon provides clients with actionable analysis and insight into multiple accounts and custodians from a single login.

REPORTING AND ANALYTICAL TOOLS FROM LEADING VENDORS

COMPREHENSIVE REPORTING

- Money line

- Daily transactions

- Trade confirmations

- Portfolio performance

- Multi-currency options

- Account statements

TRADE SUPPORT

Celadon delivers fast and anonymous execution, comprehensive analysis and reporting, and a suite of automated and algorithmic tools.

We leverage best-in-class technology and unparalleled industry relationships to facilitate trades that span the full spectrum of complexity and size. Our traders respond to ever-changing market conditions while keeping clients fully informed.

RISK MANAGEMENT AND POSITION MONITORING

- Monitor dynamic changes in market value for long, short, or net positions

- Manage individual trading clearance in real-time

- Control risk parameters for individual accounts and groups of traders

TRADE MANAGEMENT

- Manage an entire portfolio from your trading platform

- Orders can be “sliced” and released periodically throughout the trading day based on your parameters

- Execution results measured against predetermined benchmarks such as VWAP and GVWAP

- Asset managers can allocate block orders automatically post-trade to selected accounts

AGENCY DESK

- Full team of experienced traders available to replace or complement in-house trading desk

BACK OFFICE SUPPORT

- Dedicated relationship manager assigned to each client

- Clearance and settlement issues handled discreetly

- Enables clients to focus completely on markets

CELADON PRIME®

Celadon’s flagship service combines robust prime brokerage services, advanced technology, and extraordinary client support.

Professional investors in need of a flexible suite of prime brokerage, execution, and service agent solutions look to Celadon Prime®. Our clients enjoy the freedom to focus on their trading strategies while we seamlessly bundle global execution, financing, clearance, settlement, and reporting services. From the onset of the client relationship, a dedicated relationship manager provides high-touch support for everything from technology to back-office operations.

Through our multiple custodial partners, Celadon provides global clearance and settlement services, as well as direct market access to all principal US market centers and over 40 execution venues worldwide.

Celadon Prime® Portal. Celadon’s proprietary account management portal serves as the core element of our integrated prime brokerage clearing process.

- Easy away-trade entry

- Manage multiple accounts and custodians from a central dashboard

- Fully customizable functionality and display

MultiPrime. Diversify and minimize custodial risk and leverage market competition through multiple custodians.

- RBC Capital Markets

- Wedbush Securities

- Interactive Brokers

COMPREHENSIVE SUITE OF SERVICES

- Full-service agency trading desk

- DVP/RVP accounts

- Simplified “away trade” reporting interface

- Capital introduction

- Start-up solutions for new hedge funds

- Competitive execution and financing rates

- Reg T or portfolio margin

- Portfolio reporting and analytics

- Online account access for managers and administrators

- Securities lending

- Cash management

COMMISSION MANAGEMENT

- Defray up to the total cost of eligible brokerage and research costs

OUTSOURCED TRADING

Celadon’s outsourced agency desk adds significant value by helping clients execute their strategies without tying up the capital and resources needed to maintain an in-house trading operation.

An increasing number of buy-side firms have turned to outsourced trading in recent years. Clients benefit from Celadon’s significant investment in trading operations infrastructure and technology. We can act as a primary trading desk, complement an in-house desk, or provide additional coverage on busy trading days. By leveraging our trading desk, you gain an experienced team of traders, each with product expertise developed over decades that is difficult to replicate.

- Primary trading desk partnerships

- Complementary satellite trading teams

- Improved efficiency

- Comprehensive expertise

- World-class infrastructure and technology

DIRECT MARKET ACCESS

Celadon provides qualified clients with broker-neutral order management systems that enable trading across all major asset classes and liquidity sources.

We are focused on providing high-performance trading infrastructure that serves as the foundation for our clients’ success. We rigorously evaluate electronic trading platforms based on an array of factors, ensuring that clients are equipped with the most advanced technology available: streaming market data, smart order routing, intuitive portfolio management tools, and more.

LEADING EDGE TECHNOLOGY

- Manage orders across all principal US market venues

- Full support for algorithmic trading strategies

- Approved systems support multiple order types, as well as integrated Level 1 and Level 2 data for ECN and exchange destinations

- Route orders to a designated venue or use smart routing features

- Point and click order pads and blotters, as well as “hot keys”

System Availability. We not only recommend these systems from leading vendors — we rely on them for our own trading.

- Sterling Trader Pro

- Refinitiv REDI Plus

SECURITIES LENDING

Celadon delivers flexible and competitive stock loan solutions to facilitate short sales or manage settlement risk.

- Traders view lists of easy-to-borrow and hard-to-borrow stocks directly within the trading platform

- Easy-to-borrow short sales executed seamlessly

- Agency desk assistance provided for short sales of hard-to-borrow stocks (e.g. subject to locate requirements)

PORTFOLIO REPORTING & ANALYTICS

Celadon provides clients with actionable analysis and insight into multiple accounts and custodians from a single login.

REPORTING AND ANALYTICAL TOOLS FROM LEADING VENDORS

COMPREHENSIVE REPORTING

- Money line

- Daily transactions

- Trade confirmations

- Portfolio performance

- Multi-currency options

- Account statements

TRADE SUPPORT

Celadon delivers fast and anonymous execution, comprehensive analysis and reporting, and a suite of automated and algorithmic tools.

We leverage best-in-class technology and unparalleled industry relationships to facilitate trades that span the full spectrum of complexity and size. Our traders respond to ever-changing market conditions while keeping clients fully informed.

RISK MANAGEMENT AND POSITION MONITORING

- Monitor dynamic changes in market value for long, short, or net positions

- Manage individual trading clearance in real-time

- Control risk parameters for individual accounts and groups of traders

TRADE MANAGEMENT

- Manage an entire portfolio from your trading platform

- Orders can be “sliced” and released periodically throughout the trading day based on your parameters

- Execution results measured against predetermined benchmarks such as VWAP and GVWAP

- Asset managers can allocate block orders automatically post-trade to selected accounts

AGENCY DESK

- Full team of experienced traders available to replace or complement in-house trading desk

BACK OFFICE SUPPORT

- Dedicated relationship manager assigned to each client

- Clearance and settlement issues handled discreetly

- Enables clients to focus completely on markets

Our Clients

Many institutional clients utilize our agency trading desk as an offsite satellite desk to complement in-house trading activity, while smaller firms use our desk in lieu of a proprietary in-house desk.

Investment Advisors

Hedge Funds

Public Companies

Private Companies

Charitable Organizations

Financial Institutions

High-Net-Worth Investors

Professional Traders

Family Offices