Since 1986, Celadon has provided financial institutions, professional traders, and high-net-worth investors with advanced tools and high-touch broker-dealer services.

Trade Execution

Agency Trading

Fixed Income

Private Securities Transactions

Market Making

Global Markets

Outsourced Trading

Prime Brokerage

Celadon Prime®

Outsourced Trading

Direct Market Access

Margin & Securities Lending

Portfolio Reporting & Analytics

Trade Support

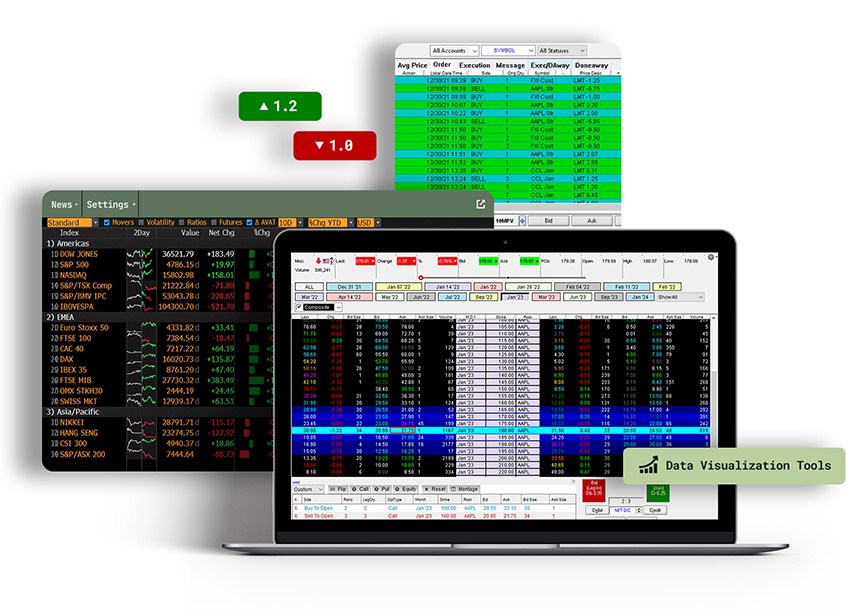

Celadon’s flagship service combines robust prime brokerage services, advanced technology, and extraordinary client support.

Celadon Prime® seamlessly bundles global execution, financing, clearance, settlement, reporting services, and personalized relationship management, so our clients have the freedom to focus on trading.

Trade with confidence — we’ve got your back office.

Learn more

Paying it forward

The Celadon Foundation, a registered 501(c)(3) nonprofit, is committed to supporting charitable organizations that are tackling vital social issues across the United States — fighting food insecurity, promoting social and economic justice, protecting the environment, enabling the creative pursuit of science, and thwarting voter suppression.